Etch Anti Theft Protection Benefits

Etch anti-theft protection involves etching a unique code on various parts of the vehicle, making it less attractive to thieves as these marks are traceable and difficult to remove.

The etching provides a permanent identification mark, which can deter parts resale in the black market, further reducing the risk of theft

Many insurance companies may offer discounts on premiums for vehicles with anti-theft measures, including etch protection, as it reduces the risk of theft.

In case the vehicle is stolen, the etched code aids in faster recovery by law enforcement, increasing the likelihood of retrieving your vehicle.

Vehicles with etch protection often have a higher resale value as buyers are assured of the additional security feature.

Extended Service Contract Benefits

Extended service contracts cover repairs and replacements that are not covered by the manufacturer’s warranty once it expires, providing broader protection.

They help manage unexpected repair costs by covering significant repair expenses, making budgeting easier.They help manage unexpected repair costs by covering significant repair expenses, making budgeting easier.

Knowing that major repairs are covered allows you to drive without the worry of unexpected breakdowns and hefty repair bills.

Regular maintenance and timely repairs covered under a routine maintenance contract can extend the life of your vehicle.

A vehicle with a transferable extended service contract might be more attractive to buyers, potentially increasing its resale value.

Many contracts include services like towing, battery jump-starts, and flat tire changes, providing help when you need it most.

If your car is in the shop for covered repairs, the contract often includes rental car reimbursement, minimizing disruption to your daily life.

Extended service contracts can often be transferred to new owners if you sell your car, adding value to the sale.

Contracts typically ensure that repairs use original equipment manufacturer (OEM) parts, maintaining the quality and integrity of your vehicle.

Extended service contracts usually offer coverage at numerous repair facilities across the country, ensuring you’re protected wherever you go.

Gap Insurance Benefits

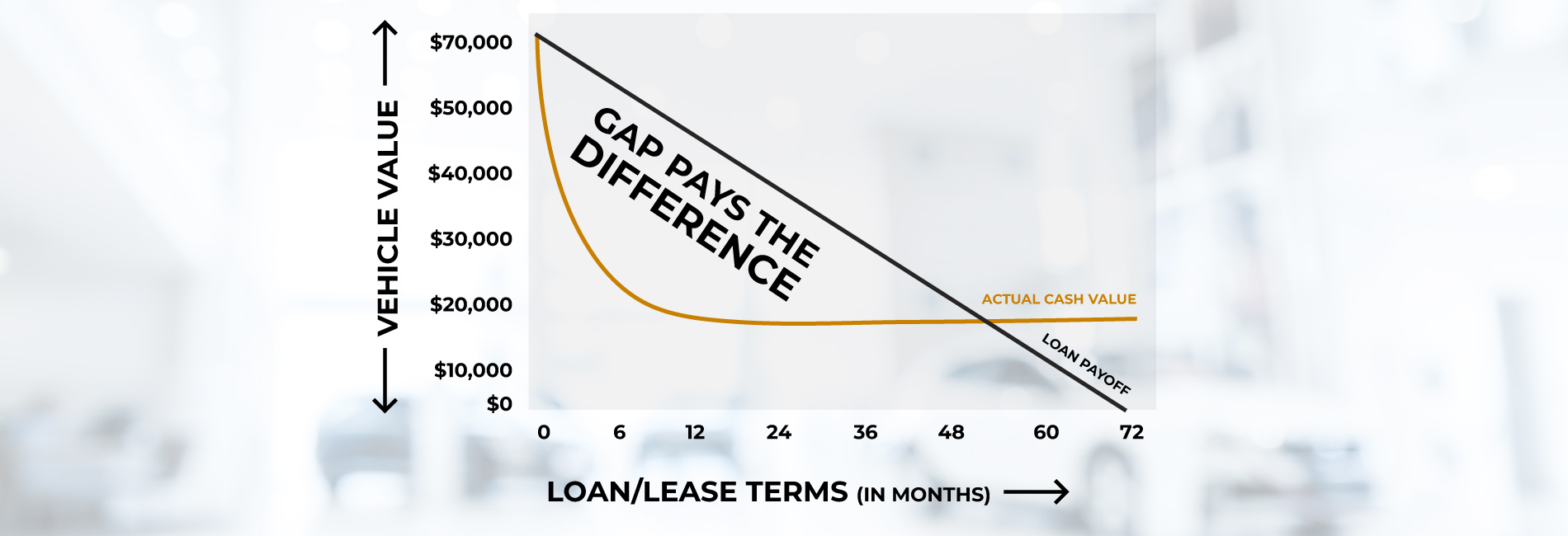

Gap insurance covers the difference between the car’s actual cash value and the amount still owed on the loan or lease, protecting you from depreciation losses.

In the event of total loss due to an accident or theft, gap insurance ensures you’re not left with an outstanding loan balance after your insurer’s payout.

Knowing that you’re covered for the gap amount provides peace of mind, especially for new car owners whose vehicles depreciate quickly.

Gap insurance is typically inexpensive compared to the potential financial burden it protects against, making it a cost-effective safeguard.

Many leasing companies require gap insurance as part of the lease agreement, ensuring both the lessor and lessee are protected in case of a total loss.